KANSAS CITY — More traditional beverage categories faced increasing competition in 2018 as new products in forms such as cold-brew coffee and kombucha entered the market. Bottled water remained a category increasing in sales while other drinks seemed to blur into multiple categories.

A July report from Mintel International Group, Ltd. spoke to changes in the coffee category.

“The $14.4 billion coffee market continues on a positive path in 2018, buoyed by a thriving R.-T.-D. (ready-to-drink) coffee segment and sustained growth in single-serve formats,” said Mimi Bonnett, director – food and drink, food service for Mintel. “Millennials show strong category engagement, consuming a range of coffee products, and show strong interest in innovative offerings, including R.-T.-D. coffees with new ingredients and added functionality.

“There are challenges in the evolving landscape for more traditional roasted coffee providers and well-established national brands to remain relevant. Suppliers also need to help consumers navigate the sundry of hot and cold beverage options.”

Data from Information Resources, Inc., a Chicago-based market research firm, revealed the struggles of national brands. U.S. retail sales of Folgers brand ground coffee, the category leader owned by the J.M. Smucker Co., dipped 6% to $1,074.4 million in the 52-week period ended July 15. Second-place Maxwell House, a brand owned by the Kraft Heinz Co., registered U.S. retail sales of $511.8 million, a drop of 7%.

U.S. retail sales in ground coffee overall slipped 0.2% to $3,993.3 million. Single-cup coffee saw a sales increase of 4.4% to $4,101.3 million.

Data from the Beverage Marketing Corp., New York, showed the R.-T.-D. coffee market rose 12% in volume and 14% in retail sales in 2017.

Coffee played a role in beverages crossing into multiple categories as well. The report “U.S. Beverage Market Outlook 2018” from Packaged Facts, Rockville, Md., stated, “The trend toward crossing one beverage category with another is well underway and appears likely to expand. Carbonated juice drinks, plant milk and coffee combinations, dairy-based energy drinks — the mixing has only just begun.”

Francisco Camacho, executive vice-president of Essential Dairy & Plant-Based for Danone S.A., addressed crossing categories Sept. 5 at the Barclays Global Consumer Staples Conference in Boston.

Francisco Camacho, executive vice-president of Essential Dairy & Plant-Based for Danone S.A., addressed crossing categories Sept. 5 at the Barclays Global Consumer Staples Conference in Boston.

“…In the past, we used to look at the categories as boxes, individual boxes that didn’t touch each other,” he said. “When, in reality, what is happening is that, today, it is a much more fluid environment in which the boxes mix with each other. So, if today we’re selling cold-brew coffee with probiotics and high in protein, what is that? Is that a probiotic product or is that a coffee, ready to drink?”

What beverage categories might include kombucha products?

Starbucks’ Evolution Fresh cold-pressed juice brand entered the kombucha segment by launching a line of beverages combining the brand’s cold-pressed juice with fermented tea such as Congou black tea, Yerba Mate, pu’erh, green tea and matcha. Brew Dr. Kombucha, a brand of Townshend’s Tea Co., introduced Harvest, a fall season kombucha flavor. The limited-edition organic beverage featured apricot, tarragon and green tea flavors.

Grand View Research, Inc., San Francisco, projects the global kombucha market to expand at a compound annual growth rate of 23%, to reach $5.45 billion by 2025, which would be up from $760 million in 2016. North America accounted for more than 58% of the global market volume in 2016.

Innovations, flavor experimentations and increasing awareness of health benefits associated with kombucha consumption should drive the market. Tea leaves and sugar are the basic raw materials for kombucha, which is produced through fermentation, according to Grand View Research.

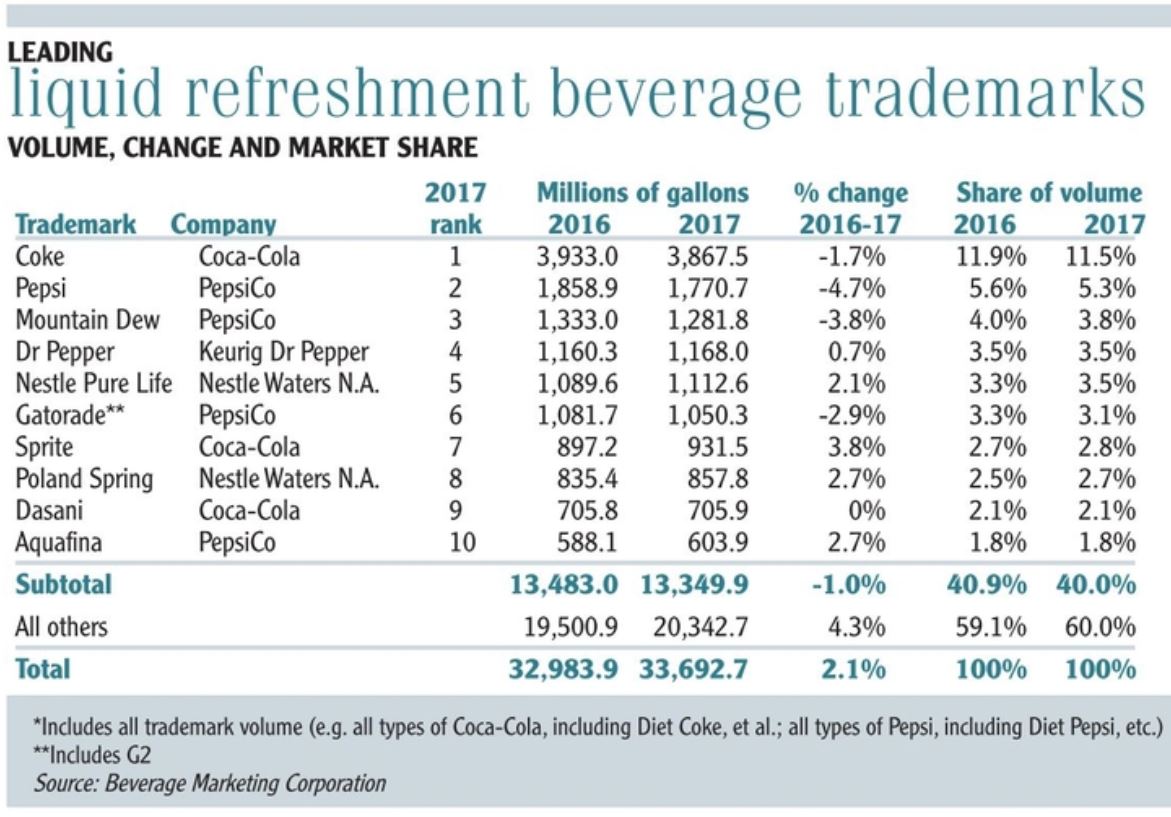

Amid all the beverage upstarts, some well-known brands remained in demand. Carbonated soft drink brands held the top four spots in the U.S. liquid refreshment beverage market in 2017, according to the B.M.C. Coke came in first with volume of 3,933 million gallons, down 1.7% from 2016, and was followed by Pepsi, 1,858.9 million gallons and down 4.7%, Mountain Dew, 1,333 million gallons and down 3.8%, and Dr Pepper, 1,160.3 million gallons and up 0.7%.

Retail sales of carbonated soft drinks in 2017 grew by 1.2% while volume slipped by 1.3% to 12.3 billion gallons, which lowered the category’s market share in the liquid refreshment beverage market to under 37%.

Retail sales of carbonated soft drinks in 2017 grew by 1.2% while volume slipped by 1.3% to 12.3 billion gallons, which lowered the category’s market share in the liquid refreshment beverage market to under 37%.

Bottled water remained the No. 1 beverage by volume, increasing by 7% to 13.7 billion gallons in 2017. Retail sales jumped 11% to $18.5 billion. Annual per capita consumption of bottled water was over 42 gallons in 2017, which was ahead of 37.5 gallons for carbonated soft drinks.

“Amid worries about obesity, diabetes, heart disease and other health matters, bottled water’s lack of calories and artificial ingredients, convenience and refreshing taste attracts health-conscious consumers,” said Joe Doss, president and chief executive officer of the International Bottled Water Association, Alexandria, Va.

In the sports drink category in 2017, volume dropped by 2.1% and retail sales decreased by 1.2%, according to the B.M.C. Gatorade, a brand owned by PepsiCo, Inc., Purchase, N.Y., remained the category leader and was in sixth place overall in the U.S. liquid refreshment beverage market with volume of 1,081.7 million gallons, down 2.9%.

“Gatorade always attracts new players into the marketplace, and they come in with either lower prices or they try to come in and build distribution, and they might take a few share points in any quarter or two, but then, over time, if you look at it over a period of five or seven years, the Gatorade franchise has been extremely resilient and has basically held onto its leadership position,” said Indra K. Nooyi, then president and c.e.o. of PepsiCo, in a July 10 earnings call.

The Coca-Cola Co., Atlanta, on Aug. 14 said it would acquire a minority ownership stake in BodyArmor, a competitor of Gatorade that offers a premium line of sports performance and hydration drinks that contain no artificial colors or flavors.

Energy drinks in 2017 were up 3.7% in volume and 2.8% in retail sales, according to the B.M.C., while R.-T.-D. tea increased 1.1% in volume and 3.9% in retail sales.

Packaged Facts forecasts the U.S. tea market to grow to $10 billion in 2022 from $8 billion in 2017.

“Teas are a beverage category in which the appeal of foreign ingredients plays a role,” said David Sprinkle, research director for Packaged Facts. “U.S. tea consumers are currently enjoying the varieties such as matcha, moringa and sencha that have long been staples of Japanese and other Asian cultures.”

Read again State of the industry: Beverages | 2018-11-27 - Food Business News : https://ift.tt/2BOFRXOBagikan Berita Ini

0 Response to "State of the industry: Beverages | 2018-11-27 - Food Business News"

Post a Comment